Loan Products

Need a personal loan? The SPCCU offers many loan products. See the details below.

Personal Loans

Mortgages:

SPCCU Terms and Conditions Apply

01.

Land Purchases

Your dream of owning your own piece of the rock can become a reality. These loans aid with the purchase of land.

Information needed:

- A letter for purchase of property which should state the location, size and cost of property. A valuation issued by a qualified appraiser

- A letter from owner indicating intention to sell, to whom and cost.

- All legal expenses derived from such transactions shall be borne by the borrower.

- A Job-letter and Recent Pay Slip

- Two Forms of Photo Identification

- Proof of Address

- Subject to SPCCU terms and Conditions, enquire at branch

- Repayment period of up to 10 years

- Interest rate as low as 6% per annum

02.

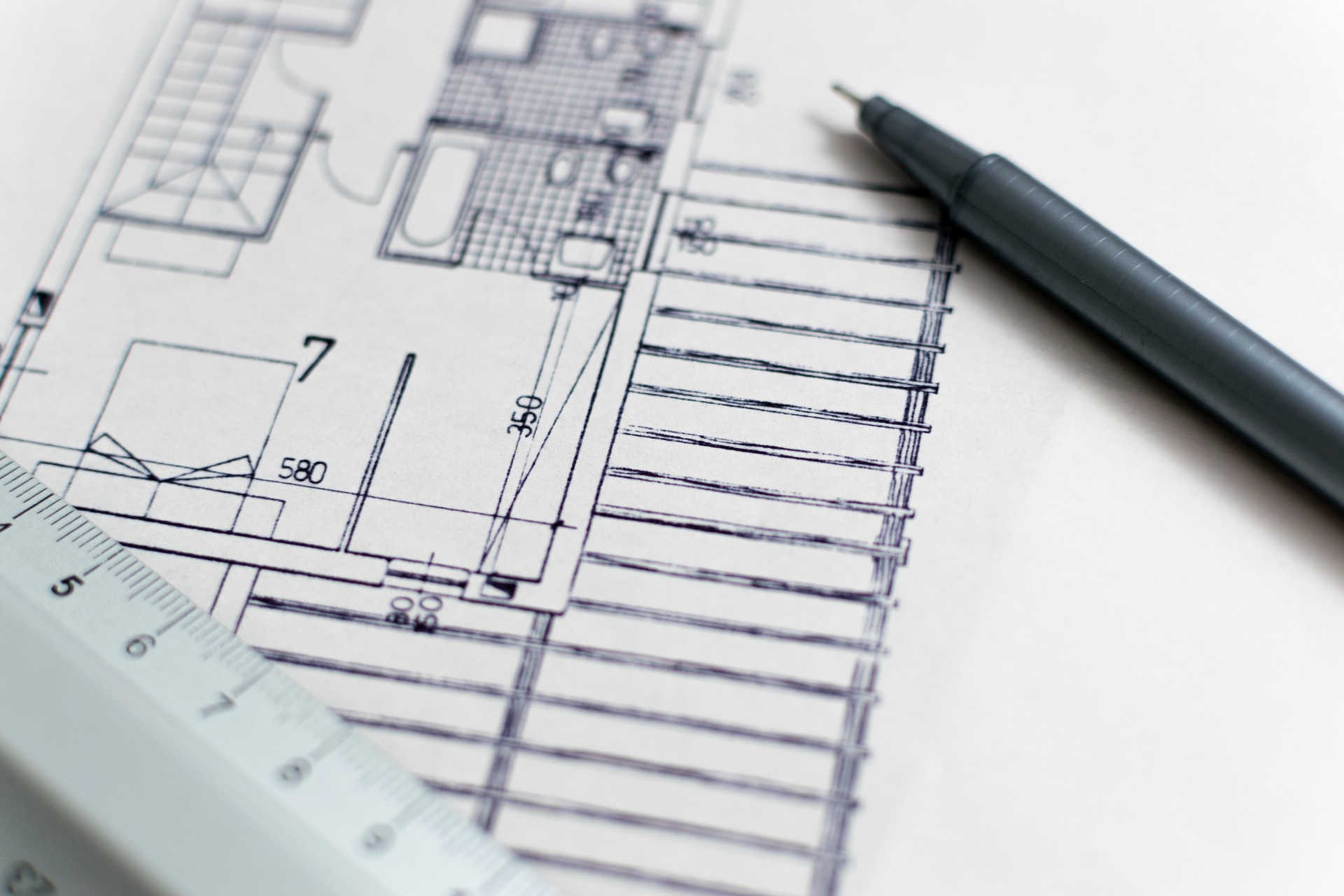

Home Construction

Build your dream home! This loan is given to finance the construction of homes.

Information needed:

- An approved plan.

- Estimates for construction

- A copy of the building contract signed by the contractor (if applicable).

- Permission to build on land (if applicable)

- Appraisal and title of property.

- A Job-letter and Recent Pay Slip

- Two Forms of Photo Identification

- Proof of Address

- Subject to SPCCU terms and Conditions, enquire at branch

- Maximum amount: $500,000

- Repayment period of up to 25 years

- Interest rate as low as 5% per annum

03.

Home purchase

Buy your own house! This loan is given to finance the purchase of a home.

Information needed:

- A letter for purchase of property which should state the location, size and cost of property. A valuation issued by a qualified appraiser

- A letter from owner indicating intention to sell, to whom and cost.

- All legal expenses derived from such transactions shall be borne by the borrower.

- A Job-letter and Recent Pay Slip

- Two Forms of Photo Identification

- Proof of Address

- Subject to SPCCU terms and Conditions, enquire at branch

- Maximum amount: $500,000

- Repayment period of up to 20 years

- Interest rate as low as 5% per annum

04.

Home repairs

These loans allow you to borrow money to remodel, repair and renovate your home or a rundown property.

Information needed:

- Drawings of proposed extensions.

- Updated Valuation Report

- An estimate of the cost of the project.

- A Job-letter and Recent Pay Slip

- Two Forms of Photo Identification

- Proof of Address

- Subject to SPCCU terms and Conditions, enquire at branch

- Repayment period of up to 25 years

- Interest rate as low as 5% per annum

05.

Vehicle Loan

This loan allows you to borrow money to purchase a new or used vehicle.

Information needed:

- Performa Invoice for vehicle from Seller to Vendor for cost of vehicle

- A Job-letter and Recent Pay Slip

- Two Forms of Photo Identification

- Proof of Address

- Subject to SPCCU terms and Conditions, enquire at branch

- Maximum amount: $150,000 (new vehicles)

- Maximum amount: $100,000 (used vehicles)

- Repayment period of up to 5 years

- 10% interest rate per anum

06.

Travel and Vacation Loan

Need a vacation? These loans are given to help finance travel and vacation expenses. They are given out between June 15th and August 30th every year.

Information needed:

- Travel itinerary and quotation from travel agency or online booking.

- A Job-letter and Recent Pay Slip

- Two Forms of Photo Identification

- Proof of Address

- Subject to SPCCU Ltd Terms and Conditions, enquire at Branch

- Maximum amount: $20,000

- Repayment period of 1 year

- Interest rate as low as 7% per annum

07.

Health & Medical Loan

This loan is used for paying off medical expenses.

Information needed:

- Letter from Doctor, Hospital etc., indicating estimates of costs.

- A Job-letter and Recent Pay Slip

- Two Forms of Photo Identification

- Proof of Address

- Subject to SPCCU Ltd Terms and Conditions, enquire at Branch

- Maximum amount: $200,000

- Repayment period of up to 5 years

- Interest rate as low as 7% per annum

08.

Student Loan

Complete your tertiary education! These loans are given to people who are aspiring to go to university.

Information needed:

- Acceptance letter from Institution and schedule of tuition fees.

- List of estimated costs for accommodation and other related expenses

- A Job-letter and Recent Pay Slip

- Two Forms of Photo Identification

- Proof of Address

- Subject to SPCCU Ltd Terms and Conditions, enquire at Branch

- Maximum amount: $150,000

- Repayment period of up to 5 years

- Interest rate as low as 6.5% per annum

09.

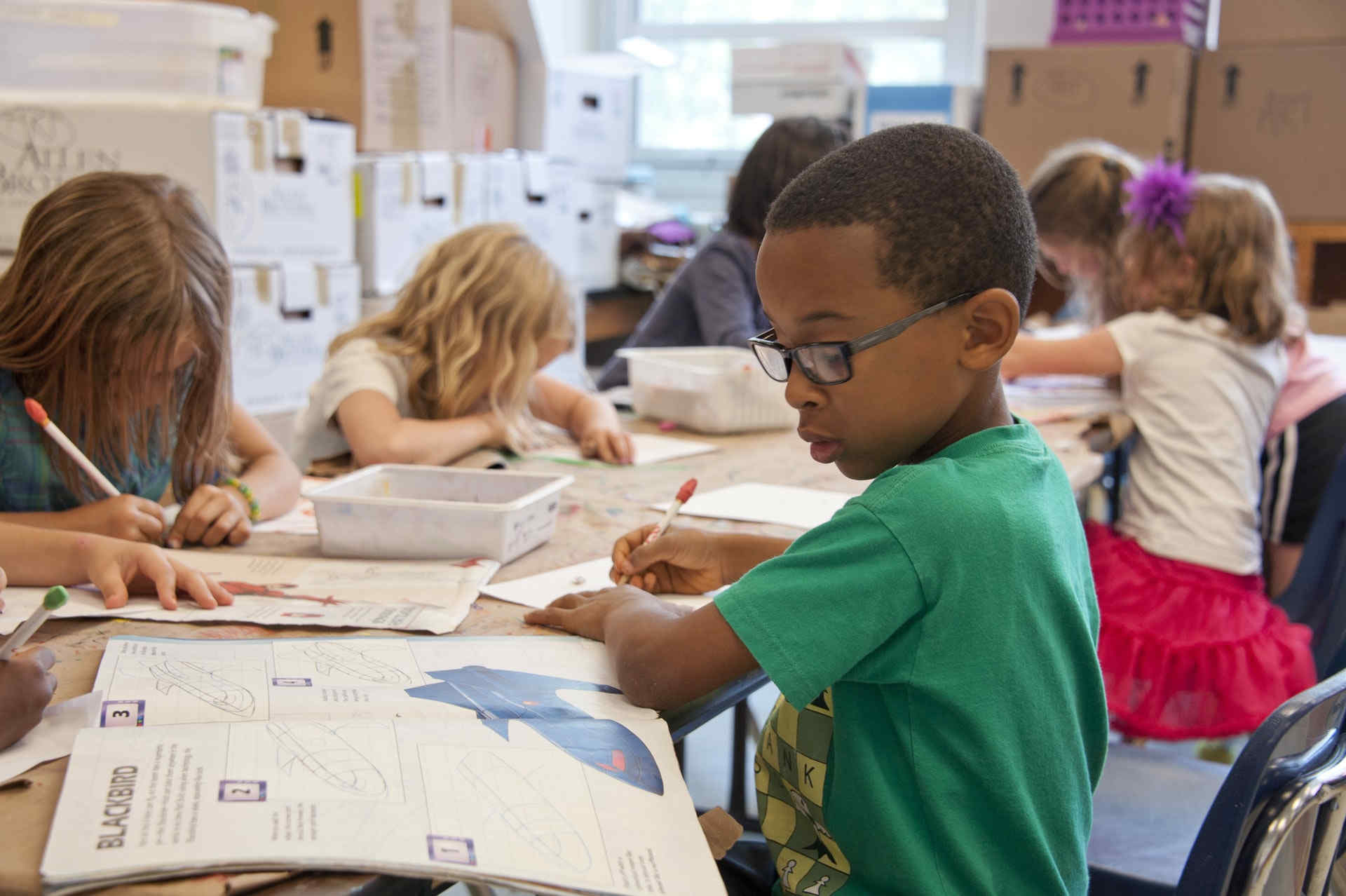

‘Back to school’ Specials

SPCCU back to school specials are loans given to parents or guardians who have a child(ren) starting/returning to school and need financial aid with school expenses. Back to school specials have a repayment period of 12 months. This special offer begins on July 1st and ends on August 31st every year. This special offer is subject to SPCCU terms and conditions.

Information needed:

- A Job-letter and Recent Pay Slip

- Two Forms of Photo Identification

- Proof of Address

- Subject to SPCCU Ltd Terms and Conditions, enquire at Branch

- Maximum amount: $5,000

- Repayment period of up to 12 months

- 5% interest rate

10.

Debt Consolidation

Relieve the stress and get a fresh start by consolidating your outstanding debts. No need to worry about making multiple payments monthly.

Information needed:

- Evidence of all bills to be paid together with most current statement from creditor where appropriate

- A Job-letter and Recent Pay Slip

- Two forms of Photo Identification

- Proof of Address

- Subject to SPCCU Ltd Terms and Conditions, enquire at Branch

- Repayment period of 5 years

- 10% interest rate

11.

Furniture and Appliance Purchase

Need to furnish your home? This loan is given to aid in purchasing furniture and appliances for your home.

Information needed:

- A pro-forma invoice of the items from vendor or quotation

- A Job-letter and Recent Pay Slip

- Two Forms of Photo Identification

- Proof of Address

- Subject to SPCCU Ltd Terms and Conditions, enquire at Branch

- Repayment period up to 5 years

- 10% interest rate

12.

Wedding Loan

Make your wedding plans! Wedding loans are dispersed at the credit union to help with all the expenses.

Information needed:

- Evidence to support pending nuptials such as:

- Copy of invitation (where applicable)

- Catering invoice

- Estimate of items to be purchase and the cost

- A Job-letter and Recent Pay Slip

- Two Forms of Photo Identification

- Proof of Address

- Subject to SPCCU Ltd Terms and Conditions, enquire at Branch

- Repayment period of 5 years

- 10% interest rate

To learn more go to our Products & Services page: